Tracking the numbers to help you understand the industry

Source: Compass Intelligence, 2015

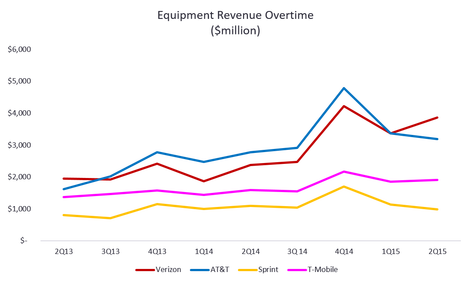

Source: Compass Intelligence, 2015 However, let me step back and say something about these metrics, since we all know it's easier to make a qualitative statement about the market without many factoids or context. Tracking quarterly financials is key for any strategic planning organization and market analytics firm for that matter. This information feeds into market forecast models and is used to recognize patterns and trends that reflect the state of the market. This information is pivotal in understanding the foundation of the business, which is why you will often see this type of information referred to as "foundational analysis." It by no means an exhaustive financial analysis but it is intended to be more than a guess of what's happening around us.

With that said, here are some of the key takeaways from the last quarter:

- Installment and leasing plans are transforming the market. CI estimates 58M (229% over this time last year) out of 247M postpaid subs (or about 23%) are on these types of plans.

- Overall churn numbers in postpaid are pretty good, which is interesting in the hyper competitive environment.

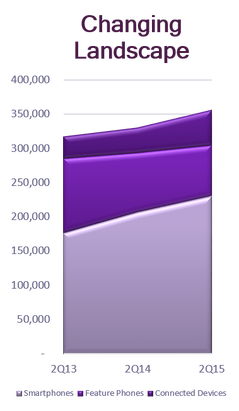

- Smartphone growth is slowing but tablets and other connected devices are on the rise. Tablet growth is up 40% in the quarter when compared to 2Q14.

RSS Feed

RSS Feed